HONORS

Joshua Richards, of Scottsdale, was recently initiated into the honor society of Phi Kappa Phi. Richards was initiated at the United States Air Force Academy.

Richards is among approximately …

Egypt has sent a high-level delegation to Israel with the hope of brokering a cease-fire agreement with Hamas in Gaza. At the same time, Egypt warned that a possible Israeli offensive focused on the …

MANILA, Philippines (AP) — Philippine forces killed an Abu Sayyaf militant, who had been implicated in past beheadings, including of 10 Filipino marines and two kidnapped Vietnamese, in a clash in …

Valley & State

An Arizona grand jury’s indictment of 18 people who either posed as or helped organize a slate of electors falsely claiming that former President Donald Trump won the state in 2020 could help shape …

Public safety

The Gilbert Police Department has located a "missing and endangered" 8-year-old girl and confirmed she is safe with family out of state.

NIGHTLIFE

Century Grand, a Phoenix cocktail destination, made its way to this year’s North America’s 50 Best Bars list, taking spot #36.

EVENT

Arizona Science Center has a brand-new series for adults – Spotlight on Science.

Election 2024

Three people are in the race for the District 1 seat on the Maricopa County Board of Supervisors, but only the Republican side will have a primary contest to see who represents the southeast Valley.

…

As Donald Trump seeks a return to the White House, criminal charges are piling up for the people who tried to help him stay there in 2020 by promoting false theories of voter fraud. Several of those …

valley business

Clate Mask said his Keap employees wanted to take the football field on its move to Chandler.

“That had to come with us,” Mask said, pointing to the artificial turf lined with …

Health care

Maricopa County is currently fighting to prevent several sexually transmitted diseases ranging from HIV to the surprising current rise of syphilis over the past few years.

According to HIV.gov …

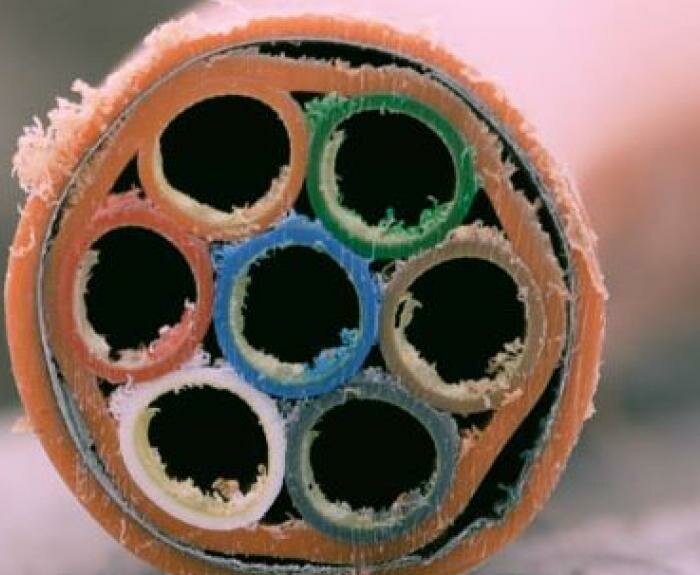

INTERNET

Arizona’s goal of expanding broadband internet access in rural areas is moving forward with a public-private partnership.

An agreement with Nebraska-based eX2 Technology is to …

Read more

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)