Short-term rentals

The saying goes, if there is money to be made, someone will do it.

If that’s the case, Scottsdale’s lucrative short-term rental industry isn’t going anywhere anytime soon. …

ANCHORAGE, Alaska (AP) — Federal prosecutors want to revoke the U.S. citizenship of a South Africa man convicted of killing two Alaska Native women for allegedly lying on his naturalization …

DEVELOPMENT

A nearly three-hour April 18 meeting led to involved 17 people coming to a podium to talk about a gas station.

Near the end of one of the longer meetings in recent Chandler history, the City …

Valley & State

MURDER CHARGE

A 25-year-old man has been booked as a suspect in a 2014 homicide that took the life of Pedro Antunez-Andrade, 19, Phoenix police said.

Phoenix homicide detectives said in September 2014 they …

Health care

PHOENIX – While lawmakers inside the Capitol were jockeying over efforts to repeal a near-total abortion ban from 1864, advocates on both sides of the issue who gathered outside the Capitol …

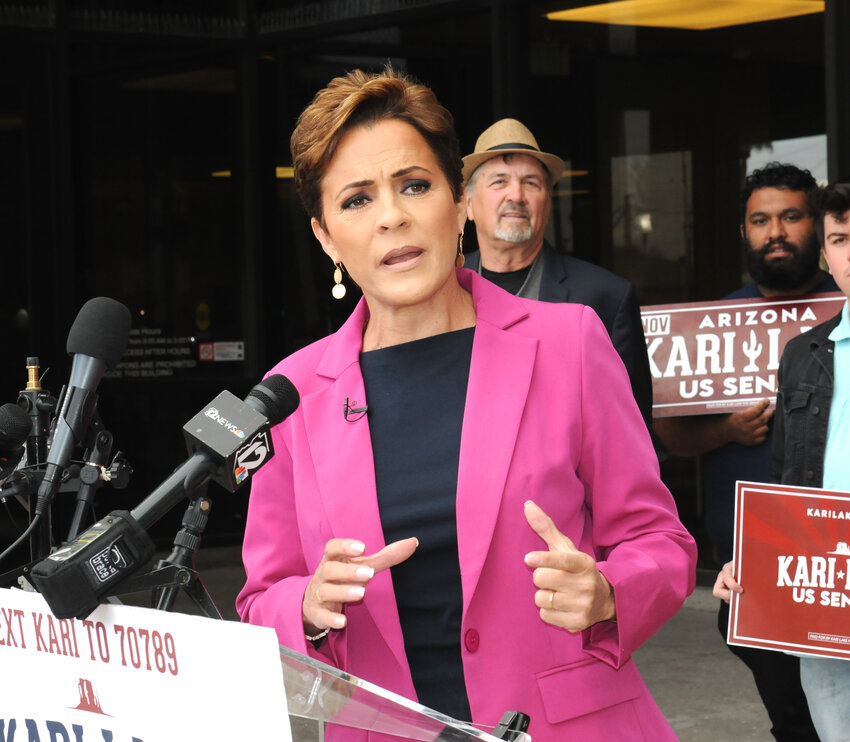

Legal

PHOENIX — Kari Lake is advancing a new legal theory why she doesn’t owe anything to Stephen Richer for the defamatory statements she made about his handling of elections: His 2024 bid for …

Viewers don't have to be young or a parent to appreciate the Australian kids' television program “Bluey,” as this week’s release of a special episode proved. Not only is the animated, …

The jury has been ordered to resume deliberations Friday in the trial of a 75-year-old Arizona rancher accused of fatally shooting a migrant on his property. The jury in Nogales near the Mexico …

HERM EDWARDS' ERA

Arizona State and four former members of its football coaching staff have reached an agreement with the NCAA on penalties for impermissible in-person contact with recruits during the COVID-10 dead …

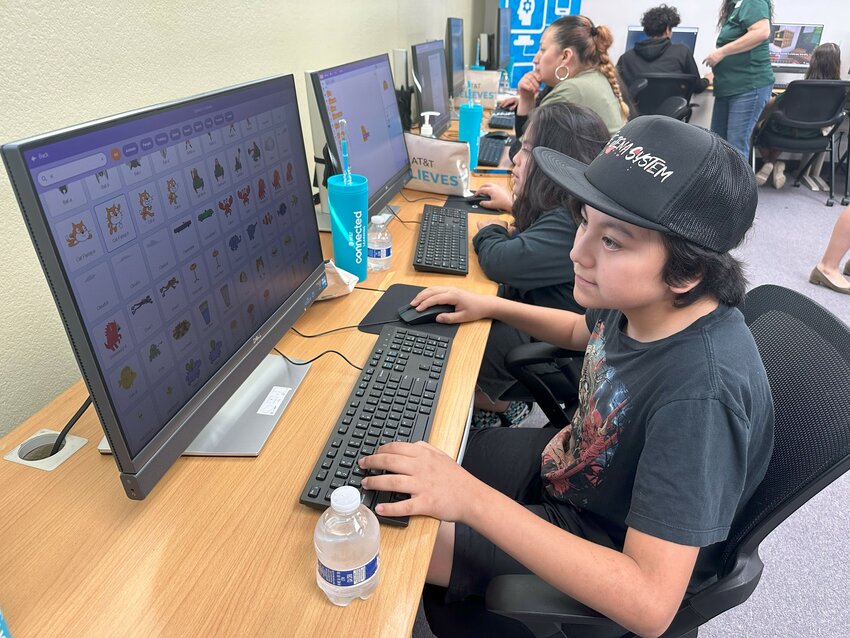

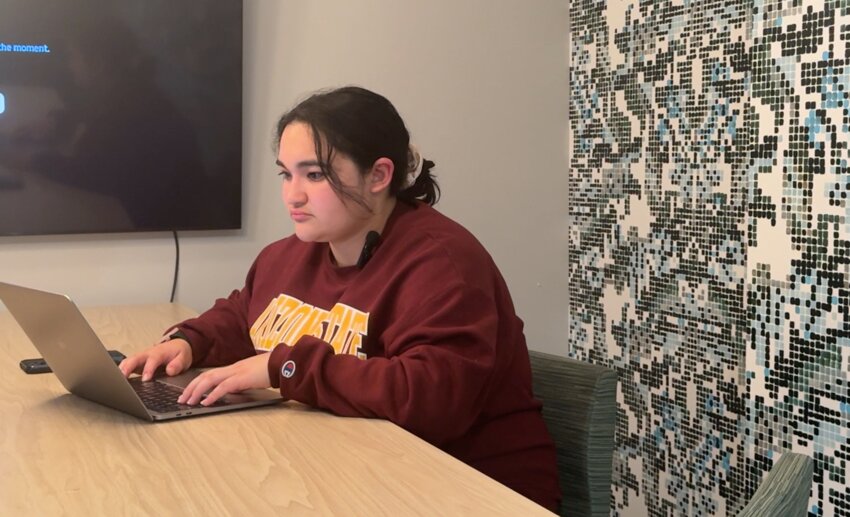

Education

PHOENIX – Students across the state are in limbo as they wait to hear how much financial aid they can expect to receive for the upcoming school year.

The Free Application for Federal …

Crime

The Pinal County Sheriff’s Office has arrested a man in Mesa in connection with a non-fatal shooting in San Tan Valley.

At around 1:10 a.m., March 29, PCSO was called to a home off Gantzel …

election 2024

Candidates officially filed their petitions April 1 to run for senator in the 2024 primary election in Arizona’s Legislative District 27, where it appears there won’t be much competition until the general election.

Read more

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Thumbnail!mt~video!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Thumbnail!mt~video!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)

!role~Preview!mt~photo!fmt~JPEG%20Baseline)